15 Aug Solving the UK’s productivity malaise through technology and innovation

Last month’s Office of National Statistics (ONS) release shows that the UK’s productivity malaise continues unabated and shows no sign of coming to an end. This sustained stagnation follows from the Financial Crisis and contrasts with patterns following previous UK economic downturns, when productivity initially fell, but subsequently recovered to the previous rate of growth trend.

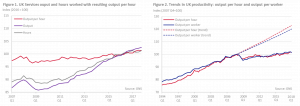

Whilst output has increased within the UK’s Services Industry since the Financial Crisis so has the number of hours worked (see figure 1). This has contributed to the slowdown in UK productivity since Q4 2007 (see figure 2) where output per hour (and similarly output per worker) has remained close to flat in comparison to the notably steeper curve prior to the Crisis.

Embrace technology

The causes of the UK’s productivity malaise are being vigorously debated by economists and range from the adequacy of the skills of UK workers, the UK’s increased regulatory burden to inadequate competition within the UK economy. Arguably, of more importance is how UK Plc responds to the challenge of increasing productivity.

A recent survey conducted by the Economist found that nearly two-thirds (64%) of UK executives described themselves as either “somewhat” or “very” confident in their ability to maximise the productivity of their departments through the use of technology. The prevalence of affordable cloud computing means that executives can fully exploit their data through machine learning and automation thereby increasing output whilst reducing the hours worked to achieve it.

However, the cost of “doing the maths” in house i.e. identifying the problem, developing the solution and implementing the approach can be prohibitively expensive for most small to medium sized business. Alternative vendor solutions can be expensive to implement requiring sizeable upfront expenditure and may not lead to a significant reduction of cost or increased efficiency. Return on investment can be slow to materialise. Narrowing margins experienced by most small to medium sized companies only compounds the problem. Taking a “punt” is not an option.

Recognising the importance and challenges of using technology within the credit and collections industry the CSA introduced a Technology and Innovation Workstream at last year’s UK Credit and Collections Conference. Due to its popularity this workstream it is back for a second year and the CSA has asked Steven Preston, of elanev, to continue his role in chairing these sessions.

OPEX not CAPEX

In this challenging market technology vendors will need to provide low-risk and simple implementations, enabling business to assess any increases in productivity without committing significant expenditure and resources. Complex integrations with no clear benefit are not viable for small or medium sized businesses.

Technology on its own cannot solve productivity issues and the associated pressures on P&L. It will need to be supported by minimal integration requirements and commercial terms based on the benefit to OPEX rather than a CAPEX expense. This approach means that businesses can assess and measure the potential benefits of technological solutions and effectively deploy these on a “cost benefit” basis. For the latest technology to be successful in addressing the UK’s productivity malaise technology vendors will need to adjust their approach too.

elanev provide their solutions using the OPEX savings approach. An example is the elanev Dialler Optimisation Solution which has proven to increase dialling efficiencies of between 30 and 40% and is deployed on a “try before you buy” approach.

For more information contact us.

Sources

Office of National Statistics, Statistical bulletin: Labour productivity, UK: January to March 2018