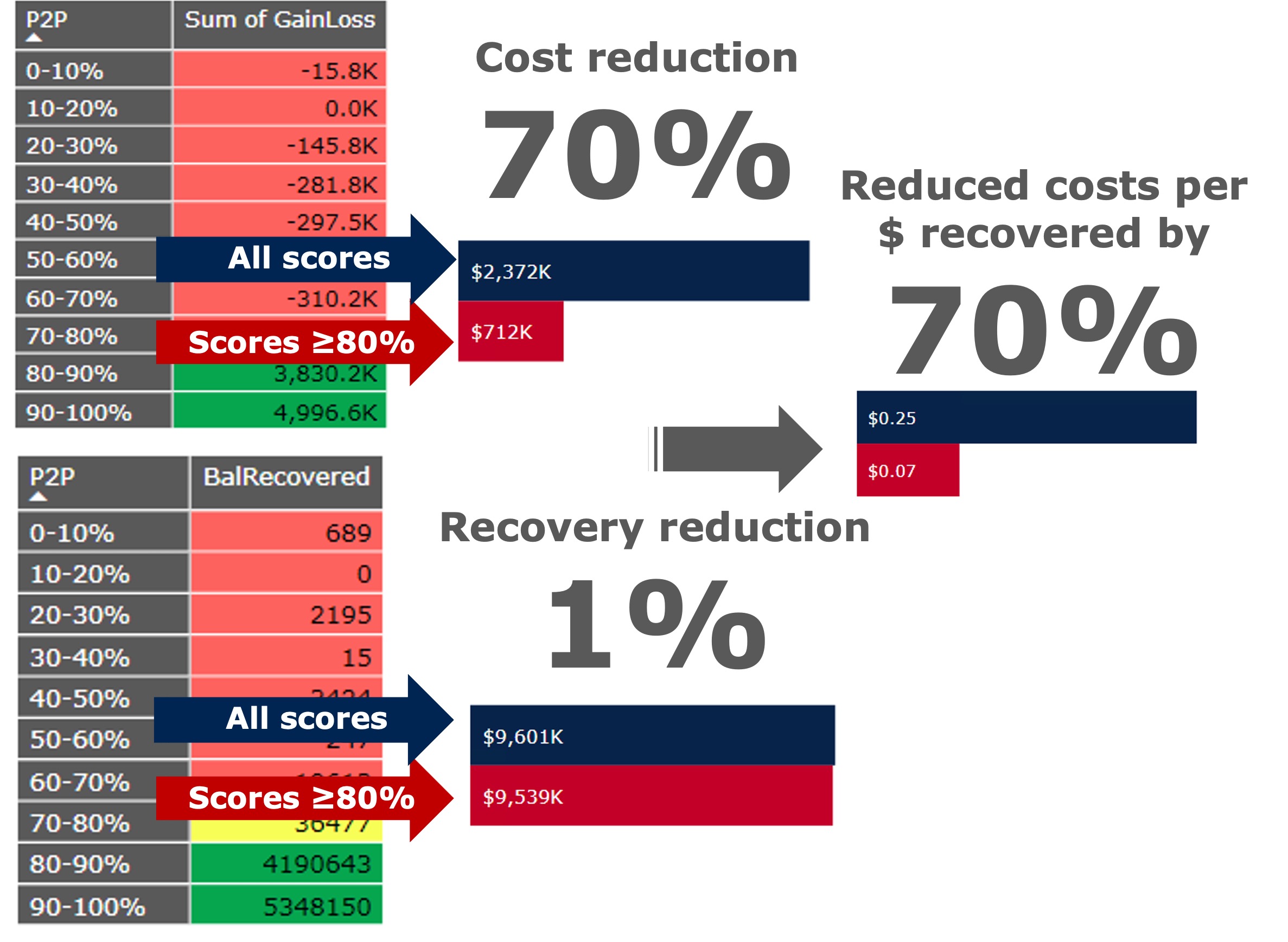

elanev Propensity scores customer propensity to an outcome. Our daily propensity for payment is proven to reduce cost of £ recovered by c.60%.

Customer Propensity

- Reduce the cost per £ recovered or £ sold

- Prioritise accounts most likely to have a successful outcome

- Propensities include propensity to purchase a new product, pay an account, respond to a channel or the best channel for the customer

- Unrivalled performance: A daily dynamic score proven to be more predictive than the market alternatives.

- UK / US wide: apply to all accounts; new, current, credit active and inactive.

- Simple to apply: dialler/systems of records agnostic

Leading clients

In live deployments daily elanev Propensity for payment scores realise c60% reduction in cost per $ recovered over incumbent big-3 bureau book-on scores.

“We are able to target paying customers more effectively increasing engagement and importantly resolution. We have reduced the costs of customer engagement whilst increasing collections. The elanev Propensity supports our move to a data driven approach.”

Theresa, Head of Collections, BPO Collections Limited. BPO partnered with elanev to integrate elanev Propensity across their collection strategies.

Client results over 12 month period

Easy to implement

No IT change required – we deploy using our secure software as a service (SaaS) approach.

No GDPR implication – no need for you to share personal identifiable customer information.

No extra cost – elanev Propensity will increase your operational efficiency so you can reduce costs and increase profit.

Pilot it now

Experience the significant business benefits of elanev Propensity for yourself. Contact us to arrange for a no obligation pilot. Our unique approach means that you will reduce the cost of each £ recovered/sold. You could be live within a week.

Frequently asked questions

READ MORE

What is elanev Propensity? Account level customer scores typically provided daily. A range of scores are available for example the propensity for a customer to take a new product, respond to a letter, SMS or email, return a call, pay an account, or return an asset.

Do you offer bespoke scoring? Yes, we can work with you to score a range of financial behaviours or outcomes and at variety of business, portfolio or book levels business case permitting.

What data do need us to provide? An inventory file; a simple daily extract from your system of records at the beginning of the day and a subsequent results file at the end of the day. No personal identifiable customer information is required within either file. We append our elanev Propensity data to your inventory file and return it prior to the start of your day’s operation. We have used a daily example, but other frequencies are available.

How is this data transferred? All three files are simple text (CSV) files transferred using secure file transfer protocol (ftp).

How do you use the results file? Your results file contains the account level outcomes from that day’s operation. We use these outcomes to re-calibrate our AI to ensure best alignment to your portfolio.

Do we need to change our existing campaign / strategies? No, elanev Propensity is designed to support your existing strategies. Segment your accounts in accordance with your strategy but use the elanev Propensity to prioritise the accounts for optimal outcomes.

How are you able to out perform bug-3 bureau scores? Our propensity scores apply the latest financial and socio-economic data and benefit from +6 years of outcome data (c. 2m per month). We tailor these to your portfolio, using machine learning, to give an unrivalled performance. As a result we can provide dynamic daily scores not just a score at book-on. In contrast big-3 bureau data derived from a measure of credit risk not the propensity for an outcome and so only apply to credit active customers not the whole population and are typically weeks out of date.

Why elanev Propensity? Our proprietary data means you could be live within hours and without the need to share personal identifiable data (no GDPR implication). We can provide highly predictive portfolio specific scores using the latest AI and we only price based on the clear OPEX saving to you. For more details click on the image below.