18 Aug Vulnerable customer data sources post COVID-19

Financial vulnerability data will play a crucial role in prioritising vulnerable customers post COVID-19.

Background

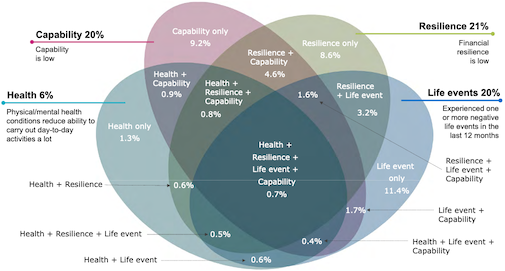

The FCA defines vulnerable customers as displaying one or more of the following drivers, all dynamic in nature:

1. Low resilience

2. Low capability

3. Suffering a negative life event

4. Having an ongoing health condition that affects day-to-day activities a lot

At the end of July the FCA called upon firms to do more to protect vulnerable customers [1]. At the same time publishing the results of its research on the percentage contribution of each of these drivers (see figure) [2]. Alarmingly, the Regulator also found that nearly half of all UK adults may be “especially susceptible to harm”. It is clear from this number, that data will have to play an increasing role in supporting firms in their efforts to respond to the FCAs vulnerable customer requirements.

Financial vulnerability is complex, multi-facetted and dynamic with customers moving in and out of the classification. Not all customers are aware that they are financial vulnerable and the converse can also apply. Indeed, some individuals seek the classification in order to reduce payment amounts, online forums providing details of how this is achieved.

To support frontline staff in managing disclosures of vulnerability effectively drills such as TEXAS [3] are used. Such assessments typically take trained call centre agents circa 45 minutes to complete. Digital journeys are a welcome innovation reducing the time taken by the provider in handling customers. Unfortunately, they do not suit all and journeys will not always fully align to customers’ circumstances being presented as a result of COVID-19. What’s more they are not as effective as well-trained call centre agents in assessing financial vulnerability which can be a highly stressed circumstance for the customer.

Whatever the preferred channel an independent measure of customer financial vulnerability is a key control particularly given anticipated volumes post COVID-19.

Application

A summary of the current data sets being used by the industry to better understand vulnerable customers is provided below:

CRA data:

- Trusted and understood

- Provides a measure of affordability but this is not the same as financial vulnerability

- Dynamic but at least 1 month out of date and often up to 3 months old

- Struggling to remain relevant during the COVID-19 pandemic [4]

Open banking:

- Dynamic but will not capture changes in circumstance yet to impact current accounts

- The financial picture is limited; does not cover savings, secondary assets or differentiate between secured and unsecured commitments therefore typically supported with CRA data

- Not all customers want to engage with open banking for example some age groups may not want to pass all of their transactional data onto each of their creditors and others may not unless they are already identify as being ‘Vulnerable’

Vulnerability registers:

- Typically includes customer self-certification and contributions from a panel of participating firms

- Self-certification only works for customers who are aware they are vulnerable or want people to think that they are vulnerable red-lining customers who are unaware of their financial vulnerability

- Significant challenges in tracking distinct individuals as they move in and out of financial vulnerability, change names, addresses etc has yet to be comprehensively addressed

- CONC requirements require that lenders need to assess the customer’s circumstances themselves, so it is not clear what protection the scheme offers such registrants

elanev Resilience:

- Offers a fully compliant UK wide cost-effective alternative

- Consists of a foundation data layer, an observed data layer and an analytics layer. An exhaustive set of dynamic UK indicators including financial, socio-economic and geodemographic data forms our foundation layer. Over this are applied consented outcome data which includes validated up to date financial assessments, including vulnerability using TEXAS drills. The observed data is applied to the foundation layer using machine learning techniques to provide the elanev Resilience measure. elanev Resilience is updated daily.

- Personal identifiable data is not required and is suppressed keeping the user GDPR compliant and the anonymity of the customer to third parties.

Conclusion

The requirements are clear; firms will need to take into account an individual’s circumstance. This can only be effectively delivered through a nuanced approach using trained agents supported by the best drills. Assessments need to be forward looking and account for the short and medium term; all data is retrospective. However, given the number of potentially vulnerable customers firms will need to leverage data to prioritise the correct customers. For a compliant and efficient assessment of your customer base, multiple data sources will need to be considered.

More details and links to supporting information

elanev works with clients to improve the efficiency of their customer contact operation. Whether that be outbound calls, SMS, emails or letters or directing inbound call volumes we are truly omni-channel. Our elanev Contact and elanev Propensity products are increasing the efficiency of our clients’ customer services. We are also a digital platform provider. We are therefore uniquely placed to give an unbiased view of software and data solutions available in the market. And where our clients see the need for a better approach, we work with them to realise it. Our award winning elanev Resilience vulnerability screen is just such an example.

[1] ‘Guidance for firms on the fair treatment of vulnerable customers’, GC20/3 Guidance Consultation and feedback statement, Financial Conduct Authority, July 2020

[2] ‘Financial Lives: The experiences of vulnerable consumers’, Financial Conduct Authority, July 2020

[3] ‘Customer Vulnerability’, Occasional Paper No.8, Financial Conduct Authority, February 2015

[4] ‘Credit scores; it’s #confuseddotcom’, Credit Connect, August 2020